Decision Horizons: Why Free, Balanced, and Firm Windows Define Your Agility

- dalerrabeneck

- Aug 18, 2025

- 5 min read

Many who know me know that I have a passion for auto racing. So much so, I’ve been teaching others to drive competitively on track for 15 years, and I’m part of an endurance racing team that competes in several events every year.

It may seem like an unusual connection, but the lessons of racing — where timing, precision, and discipline matter most — map directly to how companies make decisions.

In racing, you can change a fuel strategy in the early laps with little consequence, but once the car commits to pit lane, there’s no turning back. The same is true in business. The further out you are, the more optionality you have. The closer you get to execution, the more commitments lock in — and the cost of change skyrockets.

The key to agility isn’t making more changes in the Firm horizon. It’s making better choices in the Free and Balanced horizons before commitments pile up.

A Brief History of Horizons

The idea of “horizons” for decision-making is not new.

Military origins: Centuries ago, generals distinguished between long-term strategy (winning the war) and short-term tactics (winning the battle). Sun Tzu captured it perfectly: “Strategy without tactics is the slowest route to victory. Tactics without strategy is the noise before defeat.”

Management theory: In the 1960s, Alfred Chandler and Igor Ansoff carried this thinking into business. Chandler’s Strategy and Structure and Ansoff’s Corporate Strategy distinguished long-term direction from short-term operations.

Supply chain practice: In the 1980s, Oliver Wight formalized Sales & Operations Planning (S&OP), creating explicit planning cycles for strategic, tactical, and operational horizons.

IBP and S&OE: By the 2000s, Integrated Business Planning extended these horizons to include financial integration and cross-functional governance, while Sales & Operations Execution (S&OE) introduced a real-time, transactional horizon.

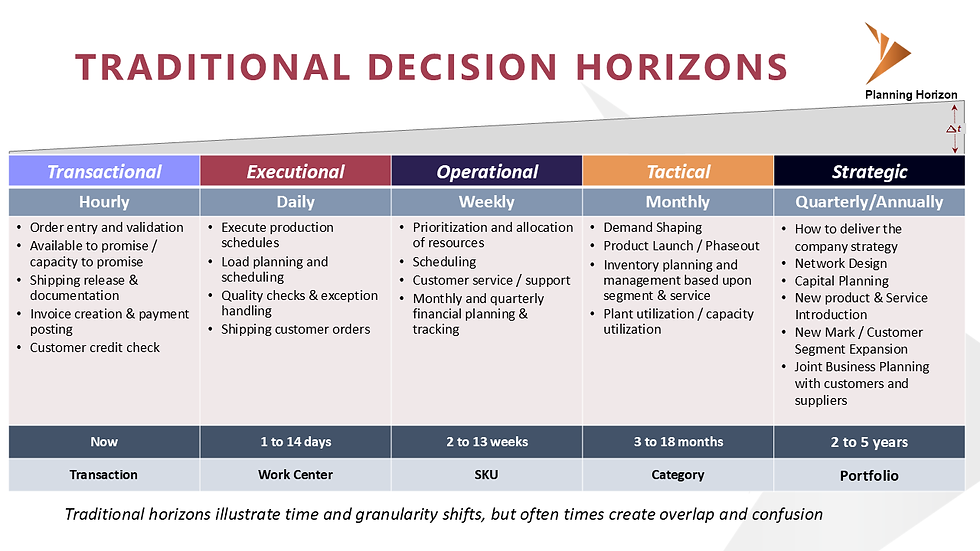

By around 2010, the five-tiered structure had become the standard language:

Strategic (18m–5y): solving for long-term direction — portfolio mix, capacity expansion, and market positioning.

Tactical (3–18m): solving for resource alignment — how to allocate constrained people, assets, and capital.

Operational (4–13w): solving for balance — matching demand, supply, and inventory in the quarter.

Executional (0–4w): solving for daily commitments — making the plan real through schedules and order promises.

Transactional (sub-day): solving for precision — the actual release, dispatch, or transaction that executes the plan.

This framework remains powerful, but too often it is misapplied. Leaders either make decisions in the wrong horizon, or they use the wrong level of detail to support the decision. That’s why at Apex, we simplify horizons into three categories that tie directly to value creation: Free, Balanced, and Firm.

The Three Horizons: Free, Balanced, Firm

While the five-tiered model is useful, in practice it often overwhelms leadership teams. At Apex, we group horizons into three categories that clarify what leaders can actually influence — and what impact that has on value creation.

1. Free Horizon (Strategic + Tactical)

Length: 3 months → 5 years

Nature: Few commitments, maximum flexibility

Decisions: Portfolio bets, sourcing strategy, capacity investments, product roadmap, demand shaping

Cadence: Monthly, quarterly, annually

Racing analogy: Early in a stint, a team can still adjust pit windows, pace strategy, and overtaking plans. They have the freedom to shape the race.

Business implication: This is where leadership can change the trajectory of the company. Choices here can unlock Revenue and EBITDA growth, bending the curve of TSR (Total Shareholder Return) or EVA (Economic Value Add).

2. Balanced Horizon (Operational)

Length: 4 → 13 weeks (the current quarter)

Nature: Commitments are accumulating, but tradeoffs can still be made

Decisions: Inventory positioning, constrained production plans, promotional events, allocation of short-term resources

Cadence: Weekly

Racing analogy: Mid-stint, your tire compound and fuel load are set, but you can still adjust pace, coordinate pit stops, and exploit track position.

Business implication: By this point, options are limited — like having already committed to buying raw material that won’t arrive for two months. Revenue is unlikely to change much, but EBITDA can still be protected or improved by managing tradeoffs wisely.

3. Firm Horizon (Executional + Transactional)

Length: Today → 4 weeks (execution) + sub-day (transactional)

Nature: Commitments are locked; changes are costly

Decisions: Order promising, shop floor schedules, dispatch, transportation execution

Cadence: Daily, hourly, or real-time

Racing analogy: Crossing the pit lane entry line — once you’re committed, there’s no backing out. A change now is too late and too expensive.

Business implication: At this point, agility is about flawless execution and agile exception management. Options are few; the focus is on minimizing unplanned impacts to COGS or working capital (DIO, DPO, DSO).

The Danger of Wrong-Horizon Decisions

When decisions drift into the wrong horizon, the costs mount quickly:

Tactical decisions left to the Firm horizon: by the time you’re adjusting promotions, inventory, or capacity tradeoffs in real-time execution, the options are gone — all you can do is absorb higher costs.

Executional decisions forced into the Free horizon: trying to lock in daily schedules or customer orders 18 months out is a fool’s errand. It looks precise but is pure fiction.

Racing analogy: It’s like trying to decide your final pit stop strategy before the green flag even waves — or waiting until you’re already past pit lane entry to decide whether to stop. Either way, the horizon is wrong, and the consequences are costly.

Granularity Matters as Much as Timing

Another common trap is using the wrong level of granularity for the horizon:

Too much detail too early: Building order-level, work-center schedules 6 months out creates a false sense of precision, while reality shifts a dozen times.

Too much aggregation too late: Using a top-down forecast to sequence a line for next week leaves operators blind to SKU-level execution realities.

Racing analogy: Telemetry from morning practice helps tune car setup, but it won’t tell you the exact fuel and tire window four hours into a six-hour race. Wrong granularity creates false confidence.

The Apex Approach

At Apex, we help leadership teams embed horizon discipline into their operating model:

Free Horizon: Strengthen strategy and resource allocation with IBP and TSR/EVA lenses

Balanced Horizon: Drive weekly operational tradeoffs that protect value while balancing constraints

Firm Horizon: Enable S&OE discipline so daily execution runs predictably and flawlessly

The goal: ensure your organization isn’t just reacting in the Firm horizon, but is proactively shaping outcomes in the Free and Balanced ones.

Getting horizons right isn’t just about drawing neat boxes on a chart — it’s about how decisions actually get made. Too often, companies use the wrong level of detail in the wrong horizon: order-level planning six months out, or trying to set long-term direction with transactional data. The result is wasted effort, false precision, and costly missteps. The matrix below highlights the impact of aligning — or misaligning — horizon and granularity in decision-making.

When horizons and granularity are aligned, organizations make faster, cleaner decisions — and agility becomes a byproduct of design, not reaction. When they drift, costs mount quickly: revenue growth stalls, EBITDA erodes, and working capital gets tied up. This is why Apex reframes horizons into Free, Balanced, and Firm. It’s a simpler, more actionable way to ensure leadership decisions are made at the right time, with the right focus, and at the right level of detail.

Closing Thought

In racing, the difference between winning and being stranded in the pits often comes down to making the right call at the right moment, with the right information. Business is no different. When leaders confuse horizons or work with the wrong level of detail, the result is wasted effort and costly surprises. But when horizons are aligned, teams move with confidence and clarity. That’s when agility isn’t just a buzzword — it becomes your competitive edge.

Ready to test your own horizons?

At Apex Performance Advisors, we help leaders align strategic intent with day-to-day execution — ensuring decisions are made in the right horizon, at the right level of detail, for the right outcomes.

👉 Explore more of the Apex Approach, or reach out to start a conversation.

Comments